If you're a startup founder, you know how important it is to keep your finances in check. But with so many accounting tools on the market, it can be overwhelming to choose the right one. That's why we've compiled a list of the top accounting tools for startup founders to help streamline your finances and boost your bottom line.

Whether you're a freelancer, a small business owner, or a growing startup, these tools offer a range of features to help you manage your finances more efficiently. From invoicing and expense tracking to payroll and tax preparation, these tools can help you save time and money so you can focus on growing your business.

With the right accounting tools, you can stay on top of your finances and make informed decisions about your business. So, let's dive into the top accounting tools for startup founders and see how they can help you streamline your finances and boost your bottom line.

Bookkeeping Tools

As a startup founder, keeping track of your finances is crucial to the success of your business. Bookkeeping tools are essential for tracking expenses, invoicing clients, and preparing financial statements. In this section, we'll review three popular bookkeeping tools: FreshBooks, QuickBooks, and Xero.

FreshBooks

FreshBooks is a cloud-based accounting software that is perfect for small business owners and startup founders. It offers a user-friendly interface that makes it easy to track expenses, invoice clients, and manage your finances. With FreshBooks, you can easily create professional-looking invoices and accept payments online. You can also track your time and expenses, and generate financial reports that help you understand your business's financial health.

One of the best features of FreshBooks is its ability to integrate with other tools such as PayPal, Stripe, and G Suite. This integration makes it easy to manage all aspects of your business from one platform. FreshBooks also offers a mobile app that allows you to manage your finances on the go.

FreshBooks

- FreshBooks is a cloud-based bookkeeping software that helps small businesses manage their finances, including invoicing, expense tracking, and time tracking. It offers features like automatic bank feeds, customizable reports, and project management.

- FreshBooks has different pricing plans starting at $15 per month for the Lite plan, which includes features like invoicing and expense tracking for up to 5 clients.

- FreshBooks has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

QuickBooks

QuickBooks is a popular accounting software that offers a wide range of features to help you manage your finances. It is one of the most comprehensive bookkeeping tools available and is used by millions of small business owners and startup founders. With QuickBooks, you can track expenses, create invoices, manage payroll, and generate financial reports.

QuickBooks offers both desktop and cloud-based versions, so you can choose the option that works best for your business. It also offers integration with other tools such as PayPal, Shopify, and Square. QuickBooks is known for its robust reporting capabilities, which allow you to analyze your business's financial data in detail.

QuickBooks

- QuickBooks is a bookkeeping software that helps small businesses manage their finances, including invoicing, expense tracking, and payroll. It offers features like automatic bank feeds, customizable reports, and inventory management.

- QuickBooks has different pricing plans starting at $25 per month for the Simple Start plan, which includes features like income and expense tracking, invoicing, and receipt capture.

- QuickBooks has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

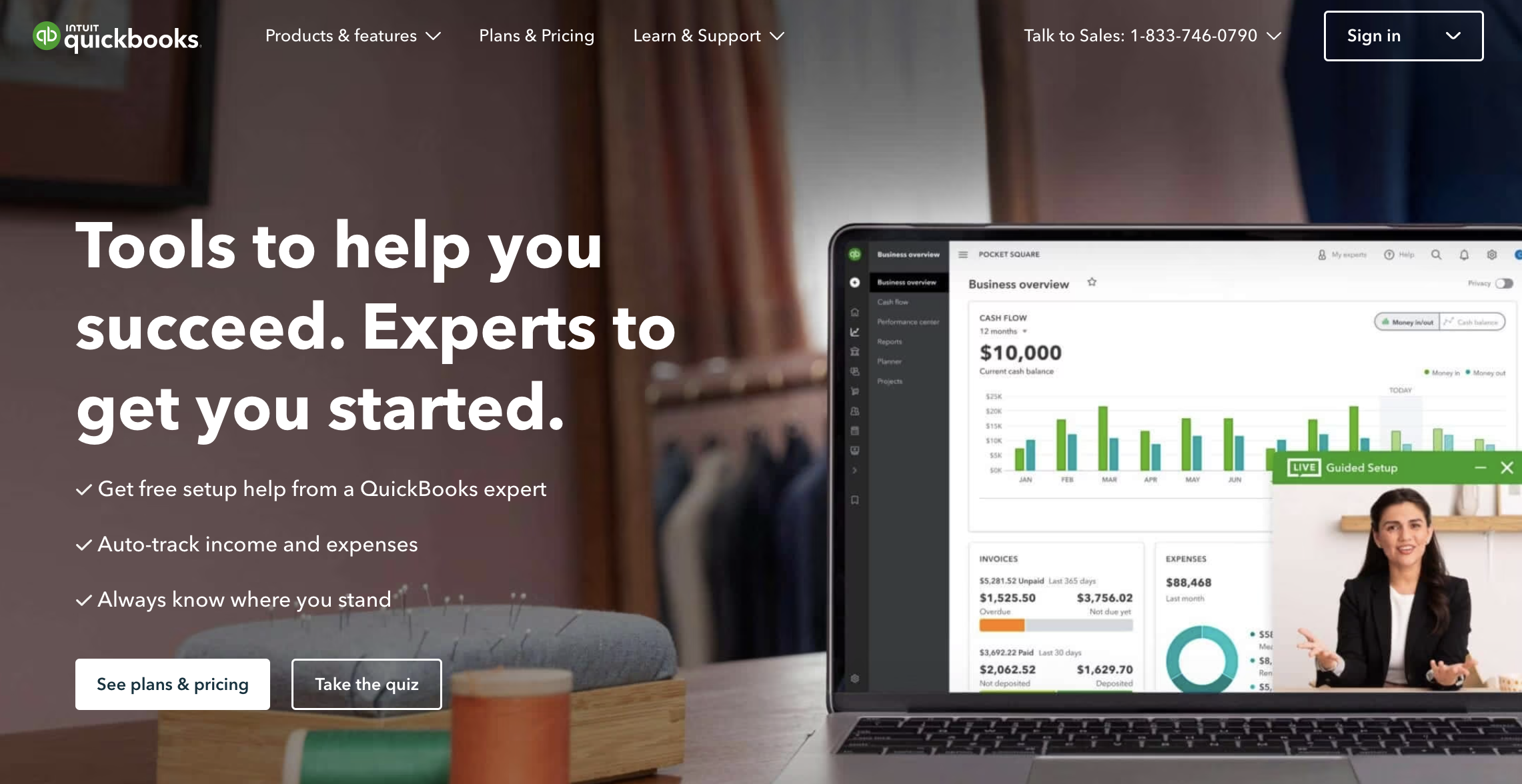

Xero

Xero is another cloud-based accounting software that offers a range of features to help you manage your finances. It is popular among small business owners and startup founders for its user-friendly interface and powerful reporting capabilities. With Xero, you can track expenses, create invoices, manage payroll, and generate financial reports.

Xero offers integration with other tools such as PayPal, Stripe, and HubSpot. It also offers a mobile app that allows you to manage your finances on the go. One of the best features of Xero is its ability to handle multiple currencies, which makes it a great option for businesses that operate internationally.

Xero

- Xero is a cloud-based accounting software for small businesses that offers features like invoicing, payroll, and inventory management.

- Xero has different pricing plans starting at $11 per month for Early, which includes five invoices and bills and basic features.

- Xero has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

Overall, FreshBooks, QuickBooks, and Xero are all excellent bookkeeping tools that can help you streamline your finances and boost your bottom line. Each tool has its own unique features and benefits, so it's important to choose the one that works best for your business.

Expense Tracking Tools

As a startup founder, keeping track of your expenses is crucial for maintaining financial stability and making informed business decisions. Fortunately, there are several expense tracking tools available that can help streamline this process for you.

Expensify

Expensify is a popular online expense-tracking tool that can help you maintain transparency around what, where, and how much you're spending. With Expensify, you can easily scan receipts, track time, and even submit expenses for approval. Expensify also offers advanced features such as automatic mileage tracking and integration with accounting software like QuickBooks.

Expensify

- Expensify is a web and mobile app that allows businesses to track expenses, scan receipts, and manage travel expenses.

- Expensify has different pricing plans starting at $4.99 per month per active user for Team, which includes basic features like receipt scanning and expense tracking.

- Expensify has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and TrustRadius.

Zoho Expense

Zoho Expense is another great expense tracking tool that can help you manage your finances more efficiently. With Zoho Expense, you can easily create expense reports, track billable and non-billable hours, and even automate expense approvals. Zoho Expense also offers integrations with popular accounting software such as Zoho Books, QuickBooks, and Xero.

Zoho Expense

- Zoho Expense is a cloud-based expense reporting software that allows businesses to automate expense reporting, track expenses, and manage receipts.

- Zoho Expense has different pricing plans starting at $5 per month per user for Standard, which includes basic features like expense tracking and receipt management.

- Zoho Expense has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

Dext

Dext is a cloud-based expense tracking tool that can help you save time and reduce manual data entry. With Dext, you can easily scan and upload receipts, invoices, and bills, and the software will automatically extract the relevant data for you. Dext also offers integrations with accounting software such as Xero, QuickBooks, and Sage.

Dext

- Dext is a cloud-based accounting software that offers features like data extraction, accountancy practice insights, and e-commerce sales data management.

- Dext has different pricing plans starting at $25 per month for Prepare, which includes automated data extraction and expense tracking.

- Dext has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

Overall, these expense tracking tools can help you streamline your finances and make more informed business decisions. Whether you choose Expensify, Zoho Expense, or Dext, you'll be able to track your expenses more efficiently and focus on growing your business.

Invoicing Tools

As a startup founder, one of your top priorities is to ensure that your finances are streamlined and your bottom line is boosted. Invoicing tools can help you achieve this goal by simplifying the process of creating and sending invoices to your clients. Here are three invoicing tools that you should consider:

Wave

Wave is a free invoicing tool that offers a variety of features to help you manage your finances. With Wave, you can create professional-looking invoices that include your company logo and payment terms. You can also send reminders to clients who have not yet paid their invoices and track the status of your invoices in real-time. Wave also offers a variety of other features, including accounting and receipt scanning, making it a great all-in-one tool for managing your finances.

Wave

- Wave is a free invoicing software that helps small businesses keep track of their bookkeeping needs from one location. It is a user-friendly, intuitive platform even for those with no prior accounting knowledge.

- Wave offers unlimited invoicing and a large number of time-saving invoice automations including recurring invoices and invoice scheduling.

- Wave has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

Zoho Invoice

Zoho Invoice is another great invoicing tool that offers a variety of features to help you manage your finances. With Zoho Invoice, you can create professional-looking invoices that include your company logo and payment terms. You can also set up automatic payment reminders to ensure that your clients pay their invoices on time. Zoho Invoice also offers a variety of other features, including time tracking and project management, making it a great all-in-one tool for managing your business.

Zoho Invoice

- Zoho Invoice is a cloud-based invoicing software that helps small businesses create professional invoices, track expenses, and get paid faster. It offers features like recurring invoices, time tracking, and payment reminders.

- Zoho Invoice has different pricing plans starting at $9 per month for the Basic plan, which includes 50 contacts, one user, and basic features.

- Zoho Invoice has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and G2.

Invoice2go

Invoice2go is a mobile app that allows you to create and send invoices on the go. With Invoice2go, you can create professional-looking invoices that include your company logo and payment terms. You can also track the status of your invoices in real-time and receive notifications when your clients have viewed and paid their invoices. Invoice2go also offers a variety of other features, including expense tracking and reporting, making it a great all-in-one tool for managing your finances.

Overall, invoicing tools can help you streamline your finances and boost your bottom line. By using these tools, you can create professional-looking invoices, track the status of your invoices in real-time, and ensure that your clients pay their invoices on time.

Invoice2go

- Invoice2go is an easy-to-use invoicing software that helps small businesses create professional invoices, track expenses, and manage their cash flow. It offers features like customizable templates, payment processing, and expense tracking.

- Invoice2go has different pricing plans starting at $5 per month for the Lite plan, which includes 100 invoices and basic features.

- Invoice2go has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and TrustRadius.

Tax Preparation Tools

Preparing taxes can be a daunting task, especially for startup founders who are already juggling multiple responsibilities. Fortunately, there are several tax preparation tools available that can make the process a lot easier. Here are three popular options:

TurboTax

TurboTax is a well-known tax preparation software that is designed to make filing taxes easy for individuals and small business owners. It offers a user-friendly interface and a step-by-step guide that walks you through the entire process. TurboTax also has a feature that automatically imports your financial data from other sources, such as your bank account or accounting software, which can save you a lot of time and effort.

TurboTax offers several pricing plans, ranging from free to more expensive options that include additional features like live support and audit protection. The cost of the software depends on the complexity of your tax situation, so be sure to choose the plan that best fits your needs.

TurboTax

- TurboTax is a tax preparation software that helps small businesses file their taxes accurately and easily. It offers features like step-by-step guidance, error checking, and automatic import of W-2s and 1099s.

- TurboTax has different pricing plans starting at $90 for the Self-Employed plan, which includes features like expense tracking and asset depreciation.

- TurboTax has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and TrustRadius.

H&R Block

H&R Block is another popular tax preparation tool that offers a variety of features to help you file your taxes. Like TurboTax, it offers a user-friendly interface and a step-by-step guide that makes the process easy to follow. H&R Block also has a feature that allows you to upload your tax documents and receive personalized guidance from a tax expert.

H&R Block offers several pricing plans, ranging from free to more expensive options that include additional features like in-person tax preparation and audit support. The cost of the software depends on the complexity of your tax situation, so be sure to choose the plan that best fits your needs.

H&R Block

- H&R Block is a tax preparation software that helps small businesses file their taxes accurately and easily. It offers features like step-by-step guidance, error checking, and automatic import of W-2s and 1099s.

- H&R Block has different pricing plans starting at $64.99 for the Premium plan, which includes features like rental property assistance and self-employment income guidance.

- H&R Block has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and TrustRadius.

TaxAct

TaxAct is a tax preparation tool that is designed specifically for small business owners. It offers a variety of features to help you file your taxes, including a step-by-step guide and a feature that allows you to import your financial data from other sources. TaxAct also has a feature that allows you to file your taxes electronically, which can save you a lot of time and effort.

TaxAct offers several pricing plans, ranging from free to more expensive options that include additional features like live support and audit defense. The cost of the software depends on the complexity of your tax situation, so be sure to choose the plan that best fits your needs.

TaxAct

- TaxAct is a tax preparation software that helps small businesses file their taxes accurately and easily. It offers features like step-by-step guidance, error checking, and automatic import of W-2s and 1099s.

- TaxAct has different pricing plans starting at $79.95 for the Business plan, which includes features like asset depreciation and rental property guidance.

- TaxAct has a high rating from users, with an average rating of 4.5 out of 5 stars on software review sites like Capterra and TrustRadius.

Conclusion

As a startup founder, you have a lot on your plate, and managing your finances can be overwhelming. However, with the right accounting tools, you can streamline your finances and boost your bottom line. By digitizing your documents, keeping up with changing tax regulations, and continually reviewing your finances, you can stay compliant and make informed financial decisions. Additionally, hiring an accountant or using automated accounting software can save you time and money in the long run. Some of the top accounting tools for startup founders include QuickBooks, Xero, FreshBooks, and Wave. These tools offer a variety of features, including invoicing, expense tracking, and financial reporting. You can also use tools like Slack and Trello to collaborate with your team and stay organized.

Remember, choosing the right accounting tools for your startup depends on your specific needs and budget. Do your research, read reviews, and take advantage of free trials before making a final decision. Incorporating the right accounting tools into your startup's financial management strategy can help you make informed decisions, stay organized, and ultimately, boost your bottom line.